Being a person in Savannah who owns a vehicle, you might have heard about the term full coverage car insurance in Savannah, GA, but do you really want it? While liability insurance is an absolute must by law, full coverage is indeed an option. Yet, most often, it is the wise choice based on your car, your driving, and local conditions.

This article explains exactly when it makes sense for Savannah drivers to have full coverage and how to figure out if those circumstances apply to them.

What Does Full Coverage Car Insurance Include?

“Full coverage” is a general term that typically combines:

- Liability insurance (covers injuries and property damage to others)

- Collision coverage (pays for damage to your car after an accident, regardless of fault)

- Comprehensive coverage (covers non-collision incidents like theft, vandalism, fire, or natural disasters)

Although it has the word “full coverage” it does not literally mean full coverage; in reality, they do come with limits and deductibles. So, it becomes important to weigh whether paying extra really is worth it.

When Do Savannah Drivers Really Need Full Coverage?

Here are the most common situations where full coverage makes good financial sense:

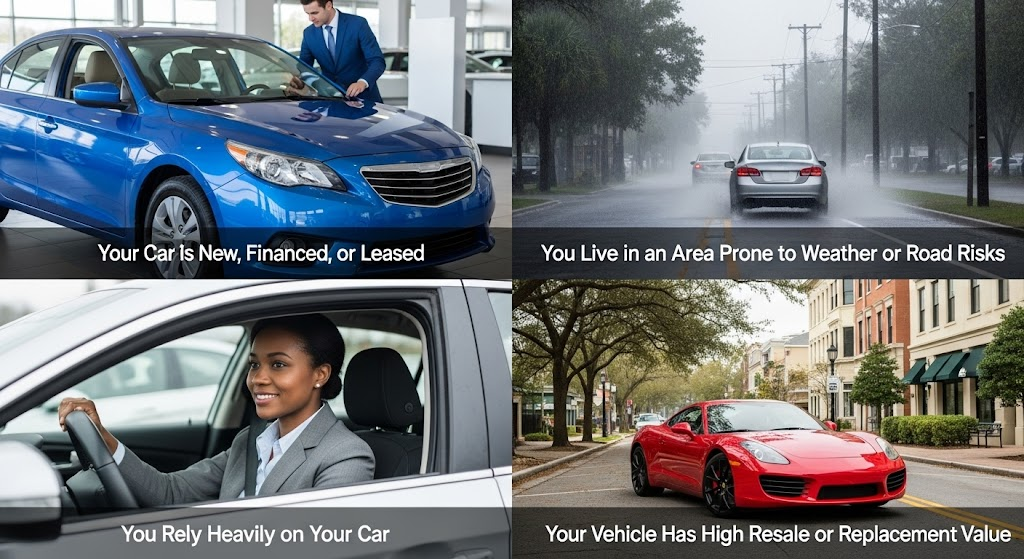

1. Your Car Is New, Financed, or Leased

If your car is under a loan or lease, your lender will always need full coverage. Even if it’s paid off, a newer vehicle still represents a major investment that you’ll want to protect.

2. You Live in an Area Prone to Weather or Road Risks

Savannah’s coastal climate means exposure to floods, fallen branches, hail, and tropical storms. In such areas, full coverage offers peace of mind. It ensures you’re covered whether you’re in a collision or your car is damaged while parked.

3. You Rely Heavily on Your Car

If your vehicle is essential for daily commutes, family errands, or long trips, the cost of not having it, even temporarily, can be high. Full coverage helps minimize downtime by covering repair or replacement after an accident.

4. Your Vehicle Has High Resale or Replacement Value

If the market value of your car is still relatively high, paying for full coverage is often worth it. It protects your financial interest in the event of theft or total loss.

How Does Commercial Vehicle Insurance Compare?

Commercial vehicle insurance in Savannah, GA, has its own class of policies meant to cover business-use vehicles. It simply cannot replace full coverage with regard to vehicles meant for personal use. However, it certainly brings home the requirement of coordinating coverage with how the vehicle is used.

Full coverage usually applies to the personal vehicles most drivers use every day. If you want to drive your car for work on deliveries or transporting goods, a commercial policy is the way to go to be adequately insured.

When Might Full Coverage Not Be Necessary?

There are also cases where full coverage may not be needed:

- Your car is older, and its market value is very low

- You have savings set aside to repair or replace your vehicle.

- You rarely drive or only use your vehicle for short trips.

- You’re comfortable taking on more risk in exchange for lower premiums.

Before dropping coverage, compare the cost of the premium against the car value now. If your deductible approaches or is more than your car value, full coverage may no longer make good economic sense.

Conclusion: Should You Get Full Coverage in Savannah?

Full coverage car insurance in Savannah, GA, depends on the value of your motor vehicle, how much you rely on it, and how much risk you are willing to undertake. For most drivers in Savannah, especially with new cars, frequent travel, and higher exposure to weather damage, full coverage makes logical sense.

Need help deciding what level of coverage fits your needs? Savannah Insurance Advisors can walk you through your options and help you build a policy that protects what matters most. Contact us at (912) 925-6916 today for a personalized quote.

FAQs

- What is the difference between full coverage and liability-only insurance in Georgia?

Liability-only insurance covers damage or injuries you cause to others. Full coverage includes liability plus collision and comprehensive insurance, which covers your own vehicle’s damages from accidents, theft, and natural disasters.

- Is full coverage required by law in Savannah, GA?

No, full coverage is not legally required. Georgia state law only mandates liability insurance. However, if you lease or finance your vehicle, your lender will likely require full coverage.

- Can I switch from full coverage to liability-only if my car is older?

Yes. If your vehicle’s market value is low and you’re comfortable taking on more risk, switching to liability-only can save you money. Just make sure you can afford potential repair or replacement costs out of pocket.